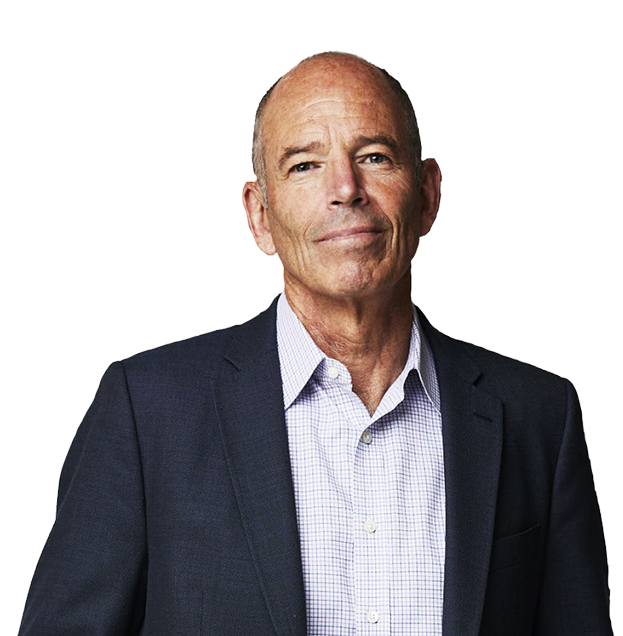

Book Me

If you’re looking for a speaker who will energize, entertain, and educate your audience.

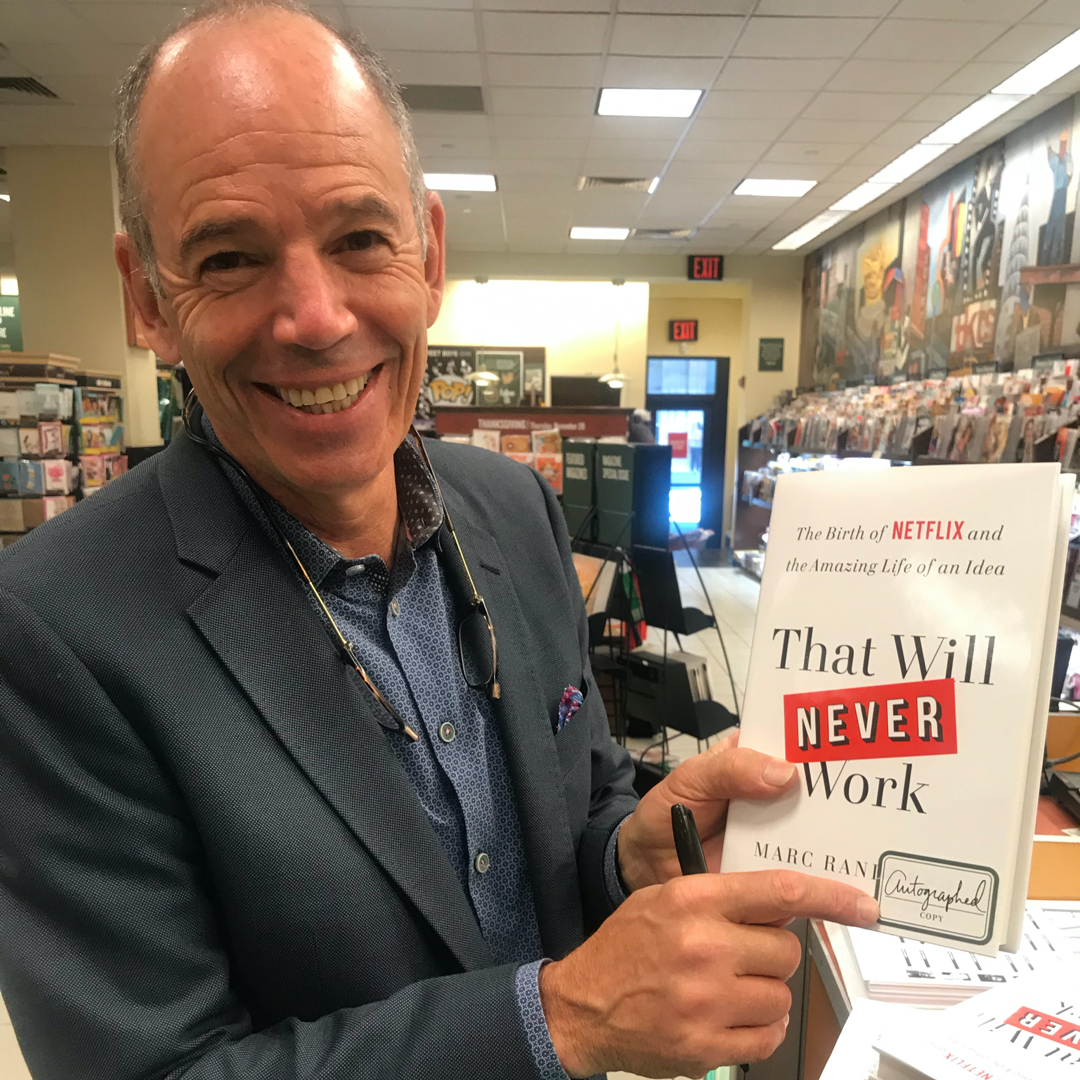

Read

Learn all the tips, tricks, and secrets I gathered from starting Netflix and 6 other companies.

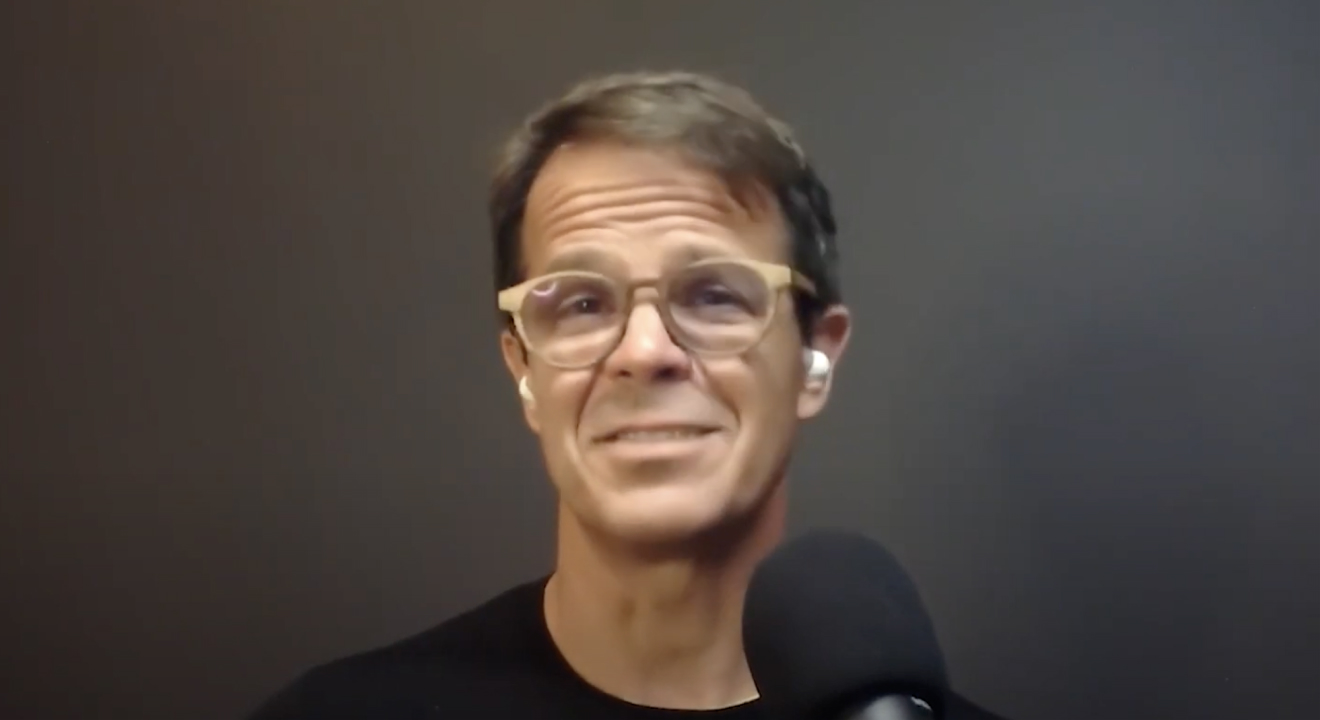

Listen

Listen in as I help real people work through their business problems.

Contact Me

Contact me - I really will get back to you.